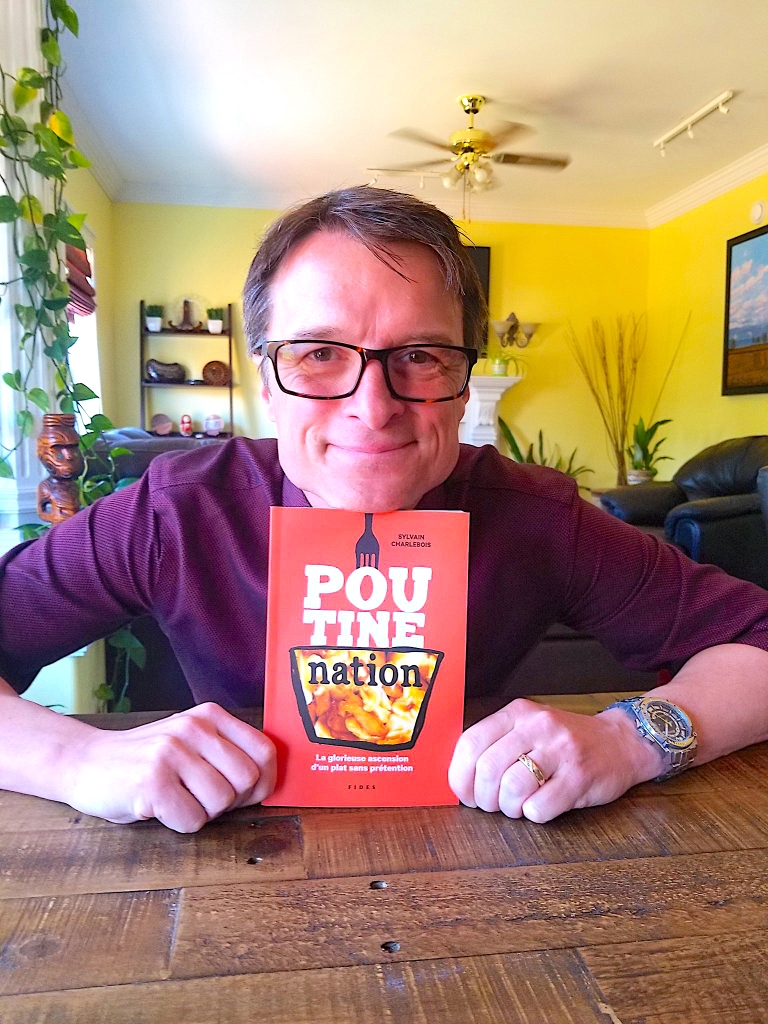

In a bustling city like Halifax, NS, where academia meets the real-world challenges of the Canadian food market, Dr. Sylvain Charlebois, Senior Director of the Agri-Food Analytics Lab at Dalhousie University, engages in a candid conversation about the pressing need for a mandatory code of conduct. Most people know him as the Food Professor.

“So essentially, we’ve seen Ottawa begging companies to come into the game market without looking at the real issue,” Dr. Charlebois begins, his voice reflective of the urgency of the matter. He identifies the core problem as the market conditions in Canada, questioning if it is truly an attractive market for international players. He emphasizes the need to scrutinize the fiscal regime and the cost of operating a business in Canada. But the focus sharpens on the dominance of two major players – Walmart and Loblaw.

“Right now, you’re seeing two companies, Walmart and Loblaw, dictating the game’s rules. And that needs to stop,” he asserts. Drawing parallels with other countries, he advocates for a code of conduct to bring discipline to the market, fostering competition and transparency. “And most importantly, for the code of conduct in particular, it would make the system a little bit more transparent and allow Canadians to understand who are the bad guys and who are the good guys.”

The discussion turns towards resistance from significant players, with Walmart notably opposed to implementing a code of practice. “No, that’s right. And that’s why they’re lobbying and trying to sway public opinion against the code of conduct,” Dr. Charlebois explains. The stakes are high, and the resistance is not unexpected, considering the potential impact on their operations.

Addressing the voluntary nature of the proposed code, the food professor expresses skepticism about its effectiveness. “If it’s voluntary, well, I don’t think Loblaw would be interested in paying a fine or being disciplined. They’ll continue and do what they’re doing right now.”

As the conversation shifts to the challenges faced by farmers, Dr. Charlebois acknowledges the complex web of supply chain margins and the limited control farmers have over their prices. “The world is asking farmers to become more competitive, more efficient,” he notes.

The dynamics vary across different industries, with some farmers finding success by reinvesting and adopting global business strategies.

In a parting remark, the optimistic tone prevails. “No, 2024 will be exciting for consumers and the industry. If we can see the government get out of the way a little bit more, it would be even better.” Dr. Charlebois envisions a year of possibilities, provided the industry has more freedom to thrive.

The conversation echoes the anticipation of change in the Canadian food market, with the hope that transparency, competition, and the resilience of farmers will shape a promising future.

In an earlier discussion, the Food Professor outlined several noteworthy trends and events that shaped the Canadian food landscape in 2023.

In 2023, the Canadian food landscape witnessed a relentless blame game around profiteering involving politicians, interest groups, and experts. Despite institutions like the Bank of Canada and Dalhousie University finding no evidence of profiteering, the issue remained contentious, leading to intense debates and personal attacks that politicized food inflation, creating a significant non-scandal that left a lasting impact on Canadians.

available on the Dalhousie website.

www.dal.ca/sites/agri-food/publications.html

Amidst competing necessities of life, a unique trend emerged between April and September. Despite higher food prices, Canadians spent less on food as rising housing costs, driven by interest rate hikes, forced households into unwanted nutritional compromises. This competition between spending on shelter and food underscored the financial challenges faced by Canadians during this period.

The Canadian food industry experienced high-profile labour disputes in 2023, impacting consumers during strikes. Notable companies, including Windsor Salt, Sobeys, and Olymel, faced prolonged strikes, marking a shift where organized labour gained political capital with increased rejections of tentative agreements by workers.

Consumer concerns extended beyond rising food prices to industry tactics like shrinkflation and skimpflation. Shrinkflation, involving reducing quantities without lowering prices, became evident in cases like Kraft Mac and Cheese. Simultaneously, skimpflation saw manufacturers changing ingredients to cut costs, anticipating more incidents due to upcoming front-of-package labelling rules in 2026.

A significant development was the long-standing price-fixing investigation in the bread market that began in 2015, which made progress. Canada Bread, now owned by Grupo Bimbo, admitted guilt in price-fixing incidents, resulting in a record $50 million fine, marking Canada’s highest penalty for price-fixing. Ongoing investigations into Sobeys, Metro, Walmart Canada, and Giant Tiger highlighted the enduring impact of the bread pricing scandal eight years later. •

— By Harry Siemens