Back on November 9, 2017, at Manitoba Pork fall producer meetings chairman George Matheson laid out for producers how MP’s new Swine Development Corporation will help farmers navigate the waters of building new barns.

producers how MP’s new Swine Development Corporation will help farmers navigate the waters of building new barns.

At this year’s district meeting in Niverville, MB general manager Andrew Dickson laid out how far the hog industry is with its actual expansion, planned expansion, and dreamers so to speak.

“There are two parts, operations in the process of renewing their structures right now, rebuilding or refurbishing, whatever you want to call it,” said Dickson. “Well if I’ve got 600 sows and I’m going to rebuild, why don’t I go to 1,200 sows meaning if I’m going to build, I may as well do a little bit extra.”

What the changes to the Planning Act allow is an existing operator wanting to make a small expansion and fixing the buildings, increase by 15 per cent. “And you can do that under the Planning Act without having to go through a conditional use hearing because they allow a certain amount of flex in the thing,” said Dickson.

The second significant stream is new producers and those looking at building something significant.

“It’s a start, and for us, it’s very important because the industry saw very little hog expansion and development over the previous ten years,” said Dickson. “Whether there will be more next year, I don’t know, but this is what people are thinking about right now.”

He said the processing plants are very engaged in this expansion, too. Part of this current development includes the HyLife developments in the Killarney area, but Maple Leaf is working with producers to help them put some buildings up and increase the amount of production in the province. Both processing plants have the capacity and want to take advantage of these markets that are opening up now with these trade agreements and so on. And it’s relatively profitable for them, so that’s what they want to do.

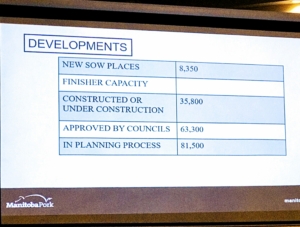

The numbers as of November 7, according to Dickson are 8,350 new sow places. In finisher capacity, constructed, or under construction, 35,800 places, approved by rural municipal councils, 63,300, and in the planning process, 81,500.

In response to the question that haunted the industry for many years, that of confidence or the lack thereof from the lending institutions.

In response to the question that haunted the industry for many years, that of confidence or the lack thereof from the lending institutions.

“There are no question organizations like Farm Credit Corporation are coming to the fore, and assisting producers with the financing of their operations, and the banks are getting involved, concerning putting up operating capital, and in some cases putting up fixed capital too,” said Dickson.

And the mix of the type producers including independents, it’s a mixture said, Dickson. Some independent producers are expanding, and in some cases, it’s new producers coming in. There’ll be new producers, and some of them will be owners of the barns, but they will contract the pigs with a processor or something like that. So there are all kinds of new business arrangements happening, so the concept of the single owner who owns the barn, owns the pigs, supplies all the labour, owns the land, takes all the manure, that’s one stream of people but there’s a whole bunch of other variations on a theme here as well.

“We have grain producers coming to talk to us about building hog barns because they’re looking at using the  manure as an offset to their costs for fertilizer,” he said. “It’s very much like the model in Iowa, where there are essentially grain, corn, and soybean producers who have hog operations because they want the manure.”

manure as an offset to their costs for fertilizer,” he said. “It’s very much like the model in Iowa, where there are essentially grain, corn, and soybean producers who have hog operations because they want the manure.”

Dickson said this increased overall confidence level in the hog industry is coming from all directions, meaning producers want to build and expand from the bottom up and processors are encouraging expansion pulling from the top so to speak.

“It’s a combination of both.” •

— By Harry Siemens